Unlocking Opportunities Through Offshore Business Development

Offshore firm development has actually become a progressively preferred technique for people and services looking for to open new chances. By developing a firm in a jurisdiction outside their home nation, entrepreneurs can use a range of benefits that can considerably boost their business prospects. From tax advantages and boosted personal privacy to asset defense and the ability to expand into new markets, overseas business development supplies a myriad of opportunities. In this discussion, we will certainly explore these possibilities carefully, shedding light on how offshore firm formation can be a game-changer for those who are wanting to thrive in a globalized economic situation.

Benefits of Offshore Company Development

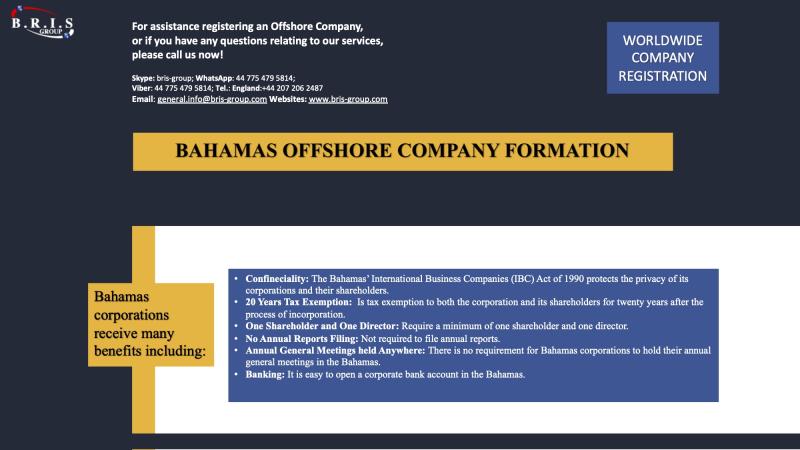

There are a number of advantages that businesses and people can delight in by creating an overseas firm. Offshore jurisdictions commonly supply beneficial tax obligation regimes, enabling companies to lawfully lessen their tax obligation liabilities.

Another benefit of forming an offshore business is boosted privacy and possession defense (company formations offshore). Offshore territories generally have rigorous personal privacy laws that safeguard the identification of company owners and shareholders. This can be especially interesting people that desire to keep their monetary events confidential. Furthermore, overseas frameworks can supply a layer of possession protection, shielding properties from possible legal claims and lenders.

Offshore business also offer flexibility in terms of business procedures. They can be utilized for a large variety of tasks, such as global profession, investment holding, and copyright management. This versatility permits firms to adjust to changing service environments and enhance their procedures.

Lastly, forming an offshore business can provide accessibility to brand-new markets and organization chances. By developing a visibility in a foreign territory, firms can use brand-new client bases, benefit from favorable company environments, and expand their worldwide reach.

Tax Obligation Advantages for Offshore Business

Offshore business enjoy substantial tax advantages because of the desirable tax obligation routines offered by overseas territories. These jurisdictions usually provide tax incentives, such as low or no corporate tax obligation prices, no capital gains tax, and no withholding tax on rewards, rate of interest, or aristocracies. These tax obligation benefits make overseas company development an attractive choice for people and services seeking to reduce their tax responsibilities and maximize their revenues.

Among the key tax advantages of offshore business is the capacity to lawfully minimize or get rid of business tax obligations. Offshore territories normally supply reduced or absolutely no corporate tax rates, enabling business to maintain more of their profits. This can result in considerable expense savings and increased competitiveness in the worldwide market.

In addition, offshore jurisdictions frequently do not impose capital gains taxes. This suggests that firms can market properties, such as stocks, genuine estate, or intellectual residential or commercial property, without sustaining tax obligation responsibilities. This can be especially advantageous for businesses associated with high-growth industries or those looking for to unload their properties.

In addition, overseas territories may not impose withholding tax obligation on dividends, passion, or nobilities paid to non-residents. This allows companies to disperse revenues to shareholders or pay passion on lendings without going through added taxes. This can enhance capital and give adaptability in handling corporate funds.

Boosted Privacy and Confidentiality

As companies and individuals check out the benefits of offshore company development, one vital aspect that typically attracts their attention is the increased degree of privacy and privacy offered by overseas territories. Offshore firm development provides a safe and secure and very discreet environment for carrying out business purchases and taking care of personal funds. Among the primary reasons businesses and people seek offshore territories is to secure their assets and maintain their personal privacy.

Offshore territories offer robust lawful frameworks that prioritize the privacy of business and financial info. These territories have strict policies in location to safeguard the privacy of their clients. They do not reveal details concerning the useful proprietors, investors, or supervisors of overseas firms, ensuring that this details remains private and inaccessible to 3rd events.

Additionally, offshore territories often provide the option of nominee services, where professional provider can serve as directors or shareholders in behalf of the firm. This setup anonymous better boosts privacy as the true identity of the advantageous proprietors remains unrevealed.

Along with the lawful structures and candidate services, offshore territories additionally provide protected banking systems and progressed financial technologies. company formations offshore. These systems ensure that economic transactions conducted via offshore firms are shielded and encrypted, lessening the danger of unauthorized accessibility

Asset Protection With Offshore Companies

One of the key benefits of making use of overseas companies is the capability to safeguard properties successfully. Offshore companies supply a robust framework for safeguarding wide range, decreasing monetary threat, and protecting assets from potential legal disputes or creditors. By developing an offshore business, individuals and services can make sure the safety and security and discretion of their properties, in addition to appreciate a higher degree of security contrasted to typical onshore structures.

Offshore territories commonly have strong regulations that guard the assets held within their boundaries. These jurisdictions offer a safe house for possessions by using rigorous personal privacy and discretion laws, making it challenging for 3rd parties to accessibility or seize properties. Additionally, offshore companies can utilize numerous property defense approaches, such as using depends on, holding firms, or complex ownership frameworks, to enhance the level of protection for their properties.

Moreover, offshore companies can assist alleviate dangers connected with political instability, economic crises, or lawful unpredictabilities in one's home nation. By branching out properties throughout numerous jurisdictions, people and organizations can reduce their exposure to such threats and guarantee the continuity and security of their riches.

Increasing Into New Markets With Offshore Firm Development

Expanding into new markets can be promoted with the calculated formation of offshore business. Offshore business formation supplies a number of advice benefits that can this post assist organizations discover and establish their visibility in brand-new markets. One of the key benefits is the capacity to lessen tax obligations and enhance tax preparation strategies. By setting up an overseas firm in a territory with beneficial tax obligation laws, businesses can minimize their tax concern and allocate their sources towards market expansion.

Moreover, overseas companies offer organizations with adaptability in terms of ownership and control. They can be structured in such a way that enables for easy transfer of shares and ownership, making it easier to collaborate and attract foreign investors with regional companions in the target audience. company formations offshore. Furthermore, developing an offshore presence can boost a company's credibility and credibility, as it signals a commitment to expanding around the world and reaching new clients

Final Thought

To conclude, overseas firm formation uses many advantages such as tax benefits, enhanced personal privacy and discretion, and possession protection. It also offers possibilities for companies to increase right into new markets. These benefits make offshore company development a feasible choice for companies and people seeking to open brand-new possibilities and achieve monetary development.

Offshore companies delight in substantial tax obligation benefits due to the beneficial tax routines offered by offshore jurisdictions. These tax advantages make overseas firm development an attractive choice for people and companies seeking to minimize their tax responsibilities and optimize their profits.

As people and services discover the advantages of overseas business formation, one essential element that frequently attracts their attention is the enhanced degree of privacy and confidentiality offered by overseas territories. Additionally, offshore companies can use various asset defense approaches, such as the usage of trusts, holding business, or complicated possession frameworks, to enhance the degree of protection for their properties.

By establishing up an overseas company in a territory with positive tax laws, businesses can lower their tax concern and assign their sources towards market expansion.